In life, we often navigate through twists and turns, facing unexpected challenges that test our resilience. One such challenge that many homeowners may face is the inability to afford their mortgage payments. As the weight of financial strain grows heavier, the question looms: what happens if I can’t afford to pay my mortgage? In this article, we will explore the possible repercussions and options available to those grappling with this daunting predicament.

– Understanding the consequences of missing mortgage payments

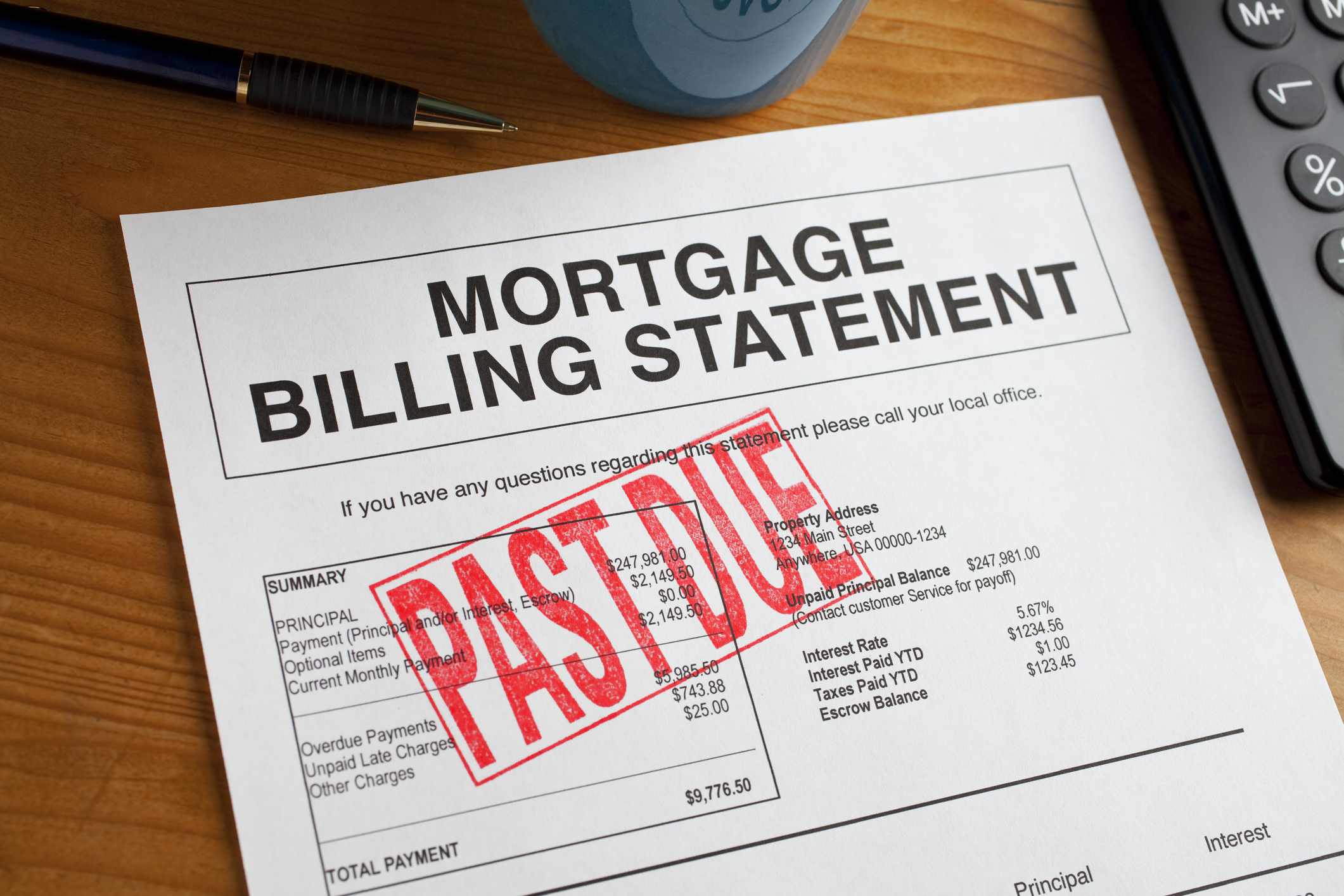

Missing mortgage payments can have serious consequences that can impact both your financial stability and your credit score. It is important to understand the potential outcomes of not being able to afford your mortgage to take appropriate actions. Here are some of the consequences you may face:

- Foreclosure: If you consistently miss mortgage payments, your lender may initiate foreclosure proceedings, leading to the loss of your home.

- Damage to credit score: Late or missed mortgage payments can significantly damage your credit score, making it harder to secure loans or credit in the future.

- Accumulation of fees: Missing payments can result in additional fees and penalties, increasing the amount you owe and making it even more difficult to catch up.

| Consequence | Impact |

|---|---|

| Foreclosure | Loss of home |

It is essential to communicate with your lender as soon as you realize you may have difficulty making your mortgage payments. They may be able to offer alternatives such as loan modification, forbearance, or repayment plans to help you stay on track. Seeking help from a financial advisor or housing counselor can also provide valuable guidance on how to manage your mortgage payments during challenging times. Remember, taking proactive steps can help mitigate the consequences of missing mortgage payments.

- Exploring options for financial assistance and loan modification

When facing financial difficulties that make it challenging to pay your mortgage, there are several options you can explore for assistance and loan modification. One possible solution is to contact your lender to discuss your situation and see if they offer any programs or options to help reduce your monthly payments or provide temporary relief. It’s important to act proactively and communicate openly with your lender to find a solution that works for both parties.

Other options to consider include researching government programs that offer financial assistance for homeowners, such as the Home Affordable Modification Program (HAMP) or the Hardest Hit Fund. These programs may provide options for loan modifications, refinancing, or financial aid to help you stay current on your mortgage payments. Additionally, you could reach out to housing counseling agencies or legal aid organizations that specialize in foreclosure prevention to get professional guidance on navigating your financial situation.

– Seeking guidance from a housing counselor or financial advisor

If you are facing financial difficulties and struggling to pay your mortgage, seeking guidance from a housing counselor or financial advisor can provide you with valuable assistance and resources. These professionals can help you explore various options and develop a plan to address your situation. Here are some potential steps they may recommend:

- Assessment of your financial situation: A housing counselor or financial advisor can help you assess your income, expenses, debts, and assets to determine the best course of action.

- Exploration of mortgage assistance programs: They can help you explore options such as loan modifications, forbearance, or refinancing to make your mortgage more manageable.

- Creation of a budget: They can assist you in creating a realistic budget to help you prioritize your expenses and make necessary adjustments to meet your financial obligations.

Remember, you are not alone in this situation. Seeking help from experts can provide you with the guidance and support you need to navigate through your financial challenges and find a solution that works for you. By taking proactive steps and seeking assistance early on, you can potentially avoid further financial hardship and work towards a more stable financial future.

– Steps to take to avoid foreclosure and protect your home

It can be stressful and overwhelming to face the possibility of foreclosure on your home. However, there are steps you can take to avoid this situation and protect your home. Here are some tips to help guide you through this difficult time:

- Communicate with your lender: Keep the lines of communication open with your lender and be honest about your financial situation. They may be willing to work with you to find a solution.

- Explore loan modification options: Talk to your lender about potentially modifying your loan to make your payments more affordable. This could include lowering your interest rate or extending the term of the loan.

- Seek assistance from HUD-approved housing counselors: These professionals can provide you with free advice and guidance on how to navigate the foreclosure process and help you understand your rights as a homeowner.

| Option | Description |

|---|---|

| Refinance | Consider refinancing your mortgage for a lower interest rate. |

| Sell your home | If all else fails, selling your home may be the best option to avoid foreclosure. |

The Conclusion

In times of financial hardship, facing the possibility of not being able to afford your mortgage can be daunting. Remember, you are not alone in this struggle. There are resources and options available to help guide you through this difficult time. Whether it’s reaching out to your lender, seeking guidance from a financial advisor, or exploring government assistance programs, there are ways to navigate this challenge and find a solution that works for you. Stay informed, stay proactive, and remember that there is always hope on the horizon. You can get through this – one step at a time.